As another week came to an end, Wall Street continued to offer its insights on Apple stock. From the Apple Car to the iPhone to the buy-on-weakness opportunity, analysts published several interesting reports on the Cupertino company.

The Apple Maven reviews some of the most interesting expert takes below.

Still bullish on Apple stock

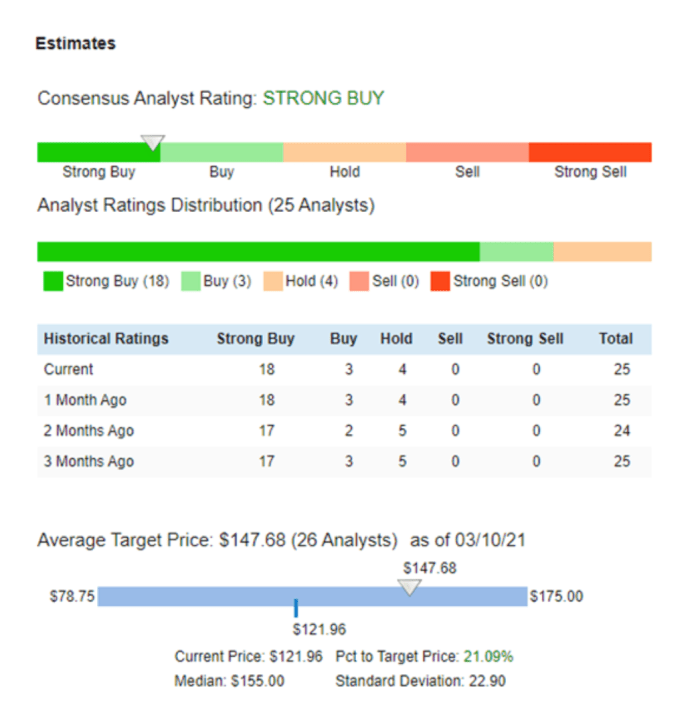

Overall, Wall Street continues to be bullish on Apple. Not much has changed since I last looked at the analyst rating and price target distribution: strong buy recommendation, target of around $148 per share. Because Apple stock has been spinning its wheels lately, the price gap to target has increased.

Check out the table below:

Hot takes of the week

One of the most attention-grabbing reports came from “the bull of bulls”, Wedbush’s Dan Ives. The analyst believes that Apple stock can nearly double in the foreseeable future, as it marches to a market cap of $3 trillion.

At the center of his optimism is the iPhone. Dan thinks that the 5G super cycle will be a game changer for the Cupertino company, and an important source of upside to consensus revenue estimates.

A few numbers help to support his case: about 350 million out of 950 million iPhones globally are due for an upgrade during this 5G cycle; and Apple’s smartphone shipments could reach 250 million units vs. the current 220 million consensus estimate.

Another analyst also sees Apple approaching the $3 trillion mark, but his path to glory looks a bit different. According to Citi’s Jim Suva, what will take the stock there is the company’s yet-to-be-released electric vehicle.

Jim says that the Apple Car should be a value creator for Apple investors, but he also warns about low margins. The automotive industry is known for being highly competitive, which would likely chip away at Apple’s impressive 38% gross margin delivered in fiscal 2020.

Lastly, Morgan Stanley’s Katy Huberty also weighed in. She pushed back on the idea that the alleged iPhone 12 production cuts pose a serious problem for Apple – an opinion shared by the Apple Maven.

The analyst sees “the supply chain data points as noise rather than an indicator of demand”. She also quotes her internal research team to argue that orders for the iPhone 12 have gone up, rather than down, when excluding the mini model.

Twitter speaks

I asked the Twitter-verse what they thought was the most important or interesting topic of conversation impacting Apple shares this past week. Here is what they had to say:

Read more from the Apple Maven:

(Disclaimers: the author may be long one or more stocks mentioned in this report. Also, the article may contain affiliate links. These partnerships do not influence editorial content. Thanks for supporting The Apple Maven)

More Stories

Moon | Cartype

Rivian, Mercedes-Benz Joint Venture Paused

We Blew Up Our $5000 Drag Car ~ Can We Getting Fixed In Time? – Humble Mechanic