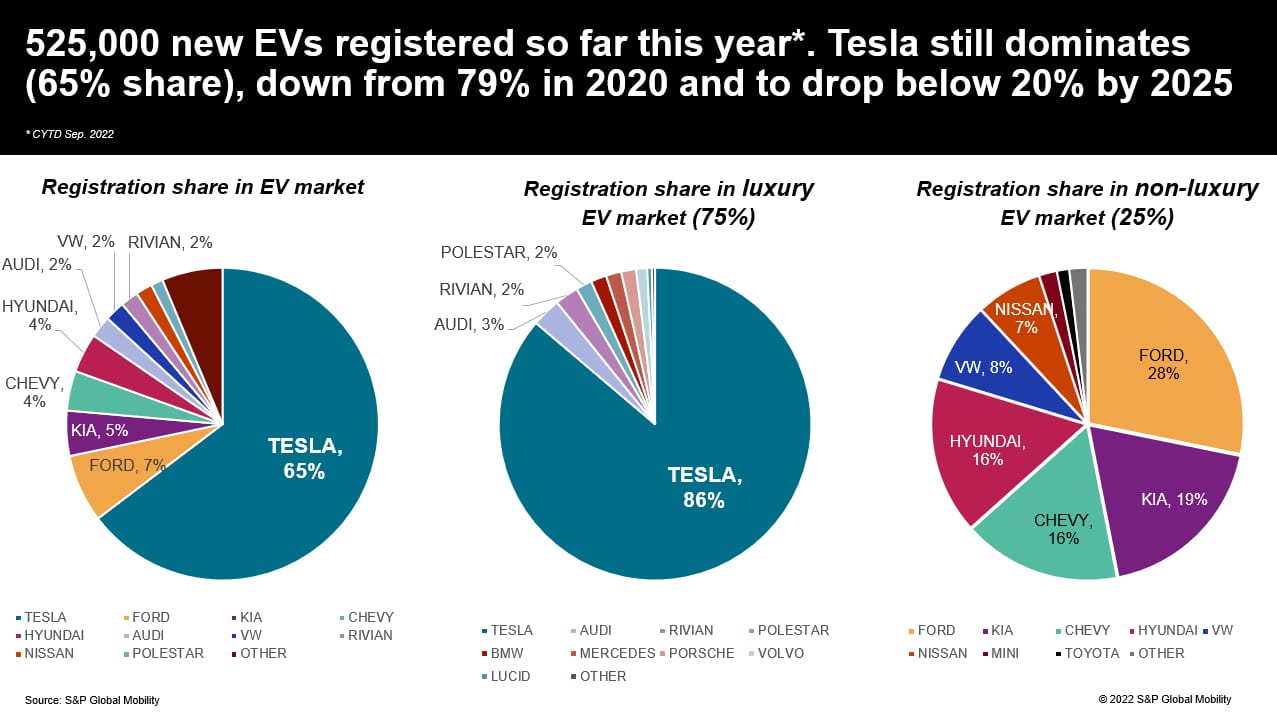

Although U.S. electric vehicle registrations remain dominated by Tesla, the brand is showing...

Tesla

The incident took place in Temple Hills, Maryland on Thursday. Sean Gallup/Getty Images A...

Tesla’s three available suites of driver assistance software have been the subject of controversy,...

Tesla (TSLA) – Get Tesla Inc Report seems determined to extend its dominance in the...

MISHAWAKA — Plans for an “electric car company” showroom and automotive center — long-rumored to...

PRIME Minister Boris Johnson is a car enthusiast – he’s been an automotive journalist...

Text size U.S. automotive-safety regulators want some answers from Tesla over its software and...

Electric car maker Tesla delivered a record number of vehicles recently, despite staring down...

As Tesla pilots self-driving cars, auto insurance may become obsolete The phrase “asleep at...

NAMBÉ, N.M. – Carmaker Tesla has opened a store and repair shop on Native...

Text size A Tesla Model S Plaid. Courtesy Tesla Stock in the electric-vehicle pioneer...

Tesla sold enough cars and energy products to turn a profit even without counting...

With an undisclosed “high-end” electric car maker looking to open a showroom and service...

Text size Courtesy Aptiv Cars are slowly becoming less about hardware and more about...

© Reuters. A labourer works in VinFast’s factory in Hai Phong City By James...

Tesla reported a jump in first-quarter profits Monday on surging electric vehicle sales, and...

Figures in the state’s car dealership industry are once again taking aim at a...

Musk has rebuffed those fears, insisting that if the electric car company was used...