[ad_1]

Rivian Automotive’s (NASDAQ:RIVN) short percent of float has risen 8.41% since its previous report. The business lately claimed that it has 55.92 million shares offered brief, which is 11.47% of all common shares that are out there for investing. Primarily based on its buying and selling quantity, it would consider traders 2.8 times to deal with their short positions on average.

Why Small Curiosity Matters

Small desire is the number of shares that have been marketed shorter but have not still been coated or closed out. Small promoting is when a trader sells shares of a company they do not own, with the hope that the rate will fall. Traders make revenue from quick selling if the price of the stock falls and they lose if it rises.

Shorter fascination is essential to track due to the fact it can act as an indicator of market place sentiment to a individual inventory. An increase in quick desire can signal that traders have turn into a lot more bearish, although a lessen in brief desire can sign they have turn into much more bullish.

See Also: Record of the most shorted shares

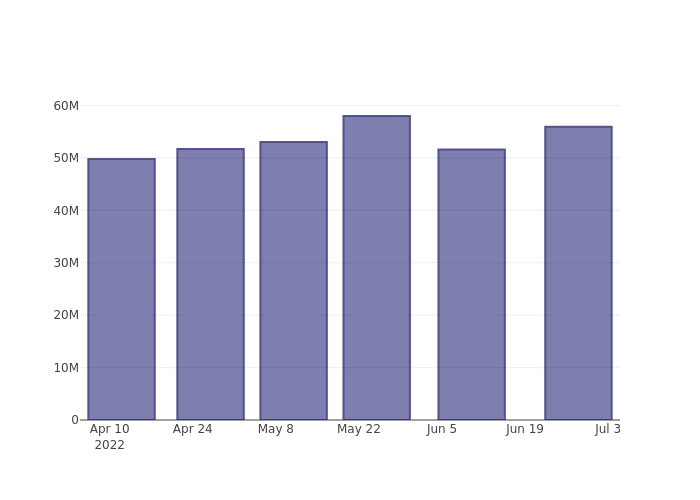

Rivian Automotive Brief Desire Graph (3 Months)

As you can see from the chart over the percentage of shares that are marketed limited for Rivian Automotive has grown considering that its past report. This does not necessarily mean that the stock is likely to tumble in the near-expression but traders really should be aware that additional shares are becoming shorted.

Evaluating Rivian Automotive’s Limited Desire Against Its Friends

Peer comparison is a well known technique amongst analysts and buyers for gauging how well a business is carrying out. A company’s peer is yet another firm that has comparable qualities to it, these kinds of as sector, dimensions, age, and economic construction. You can discover a firm’s peer team by reading through its 10-K, proxy filing, or by accomplishing your individual similarity assessment.

According to Benzinga Pro, Rivian Automotive’s peer team regular for limited interest as a share of float is 16.77%, which suggests the company has much less quick curiosity than most of its peers.

Did you know that growing brief desire can basically be bullish for a inventory? This article by Benzinga Money describes how you can financial gain from it..

This article was created by Benzinga’s automatic content engine and was reviewed by an editor.

[ad_2]

Resource url

More Stories

The World’s Only FIA Endurance Racing Minivan

McLaren, Lockheed Will Collaborate On “Futuristic” Supercar Design

2023 Mercedes-AMG GT to be crowned by 831bhp plug-in hybrid