[ad_1]

The most essential component of an vehicle-bank loan is arguably the curiosity rate. It straight influences the size of month to month payments and total loan tenor. Fascination prices can even perform a function in the remaining obtaining determination, potent ample to override sentimental obtain motives this kind of as model loyalty. It goes devoid of saying, as a result, that probable car consumers fork out consideration to things that decide their fascination prices when buying for auto-financing solutions.

A single of such aspects is the credit rating rating. It is effectively a weighted score that tells vehicle-loan companies how a lot threat they are having on by working with a potential borrower. You most probable have a credit score report if you have any credit score accounts, this kind of as credit score cards, mortgages or loans. This report then kinds the foundation for deciding your credit rating rating.

It is not an exact evaluate, but it does lose mild on aspects such as the borrower’s willingness and potential to provider the financial loan. Basically set, the far better your credit history rating, the greater your odds of securing an vehicle mortgage with favourable desire costs. This is specifically critical nowadays as we navigate the period of desire fee hikes and inflationary pressures.

Making use of your credit score score to secure the ideal curiosity rates

Via Experian

The in general reason of the credit rating score is common. Even so, diverse loan providers in distinctive components of the globe have their possess conditions to measure an individual’s creditworthiness. When you utilize for an car personal loan in the US, the financial institution will run a credit score verify as portion of the course of action. The vast majority of the lending institutions use FICO credit rating scores. This is a 3-digit score assigned to a borrower following the credit verify exercising.

It was to begin with produced in 1989 by a data analytics organization termed Good Isaac Organization. Today, there are several variations of the FICO algorithm (and other scoring versions, for that matter), but they are all aimed at ascertaining the borrower’s capacity to choose on credit.

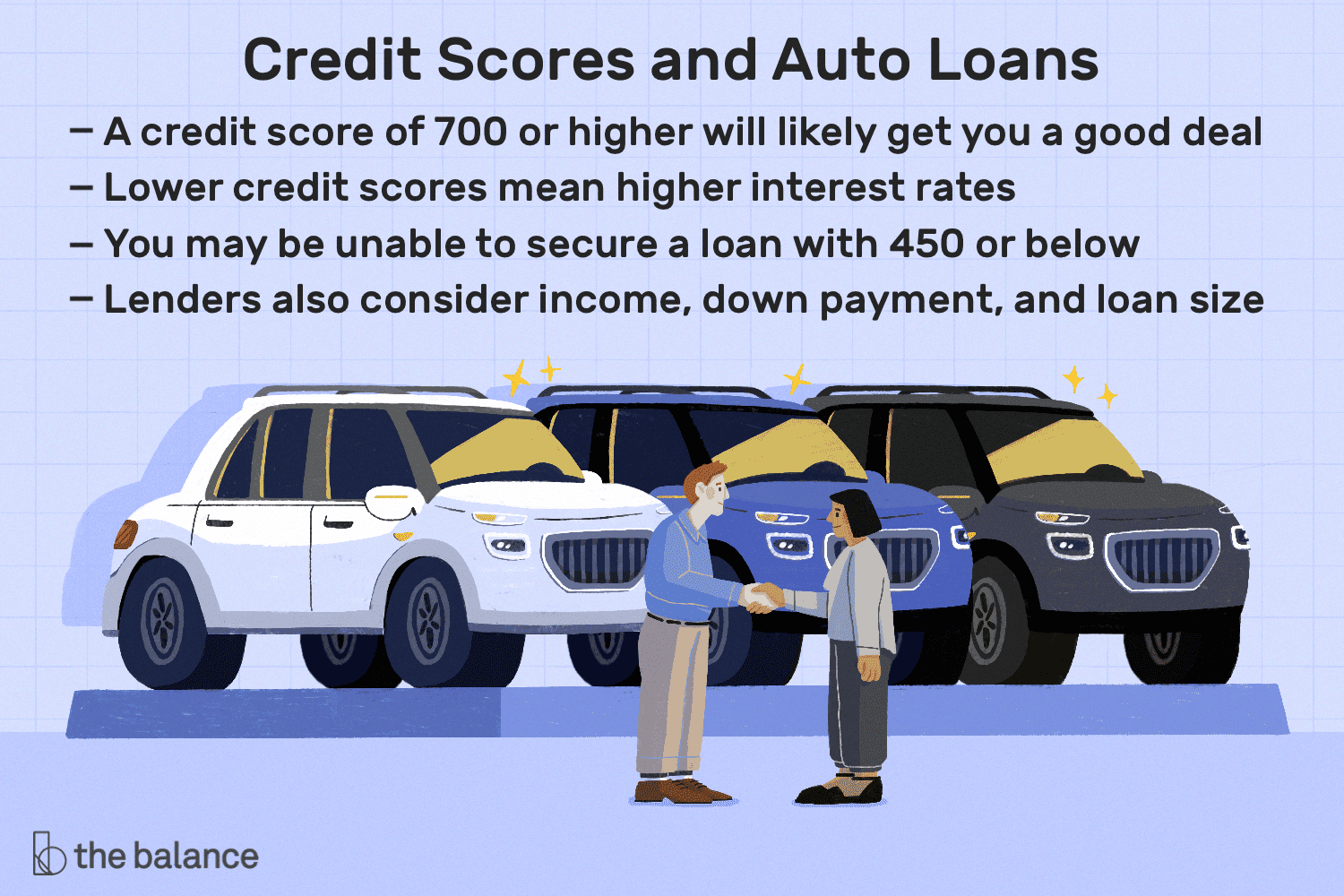

Through The Harmony

According to the CFPB (Client Money Security Bureau) Purchaser Credit Panel, there are 5 different borrower profiles sorted into the subsequent credit score score buckets: Super-primary (720 & previously mentioned) Key (660-719) Close to-primary (620-659) Subprime (580-619) Deep subprime (below 580). A borrower with a score down below 660 can nonetheless secure automobile financial loans, but they will be extra high-priced than a Prime or Super-key borrower with a rating north of 661. The logic below is that you will want to preserve your credit score as superior as achievable to get the very best discounts when searching for vehicle loans.

Points that hurt your credit history rating

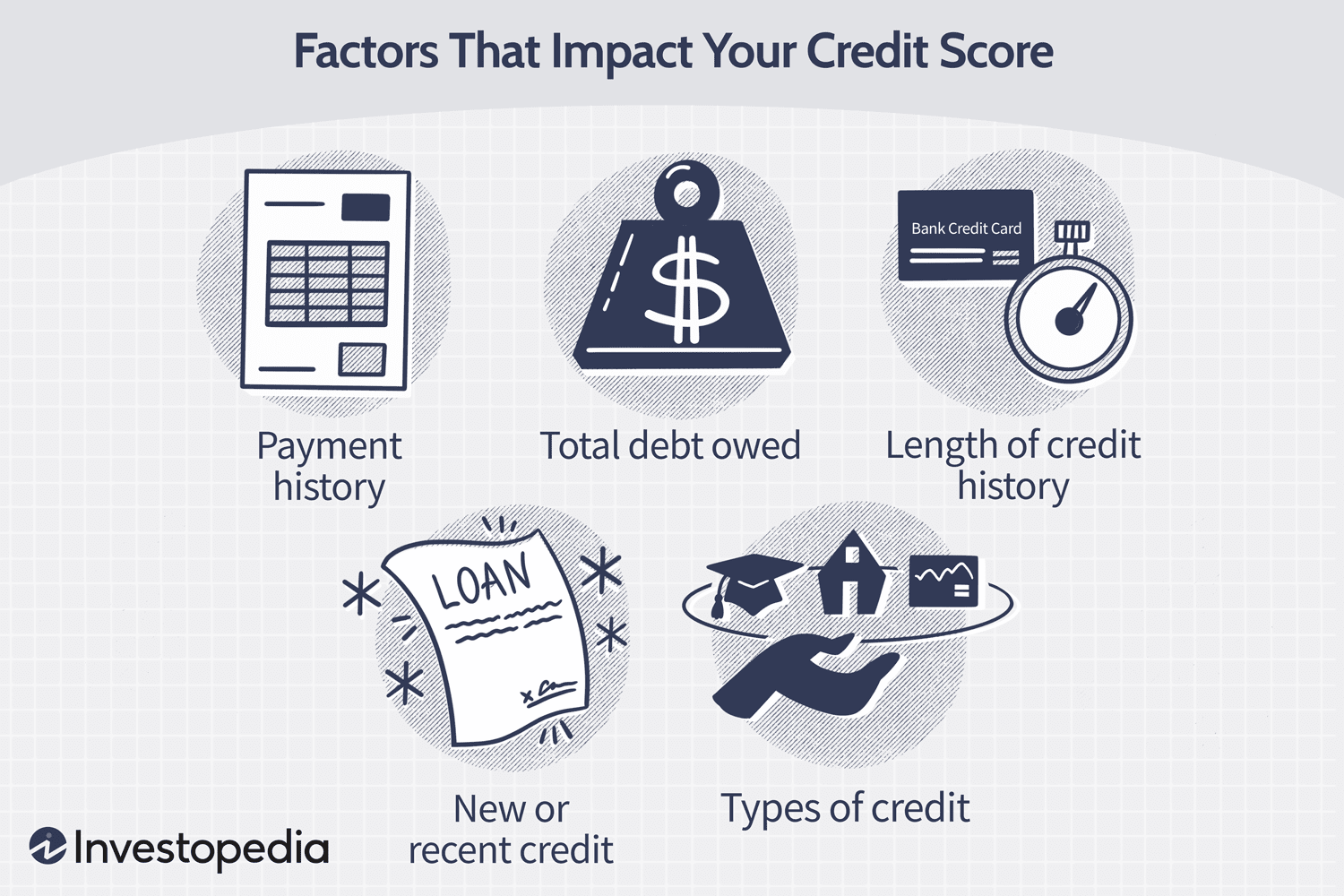

Via Investopedia

An superb credit score score is the outcome of thorough and deliberate setting up, and being aware of the possible pitfalls can aid the borrower stay away from making missteps that pull down the rating into undesirable territory.

Generating a late payment

Payment heritage on your credit obligations accounts for up to 35% of the FICO score. In accordance to FICO, a payment that is 30 days late can charge a person with a credit rating of 780 or greater anywhere from 90 to 110 details. It is critical to make payments as at when because of and proactively reach out to the lender if, for any purpose, payment will be delayed.

A large financial debt-to-credit rating utilization ratio

Credit heritage is crafted by a frequent cycle of credit utilization and shell out downs. Nevertheless, you will want to preserve an eye on the proportion of your debt load to all round credit. The lower your balances relative to your whole readily available credit score, the greater your score will be.

Non-utilization of credit

On the other hand, no credit score record for an prolonged interval can also adversely have an affect on the borrower’s credit rating score. Loan companies and collectors have almost nothing to report to credit bureaus when you really do not utilize your credit accounts. This will make it a lot more complicated to examine long run bank loan programs.

Personal bankruptcy

Filing for bankruptcy has one of the most sizeable impacts on your credit history rating. It can wipe as substantially as 240 points from an individual’s score, and what’s a lot more? A personal bankruptcy report can keep on the credit rating historical past for up to 10 a long time.

This list is by no signifies exhaustive, and other things these as frequency of credit history purposes, credit card closure, cost-offs and refinancing all impression credit history scores in different degrees.

Enhancing your credit score score

Strengthening your credit history rating will require steering clear of the pitfalls before discovered over. Procedures this kind of as prompt and common invoice payments, keeping a reduced credit card debt-to-credit rating utilization ratio (preferably about 30%), keeping credit score card accounts open and staying away from various financial loan apps at at the time are all measures in the correct route.

On the other hand, even with all these ‘building blocks’ in place, a terrific credit score is not instantaneous. It might consider a when to see any enhancement, primarily due to the fact detrimental reports can stay on your credit historical past for many years. There is no rigid time body for credit rating score expansion as each person’s economical circumstance is exclusive. In accordance to Forbes, it could just take anywhere from a month to as much as 10 a long time. Definitely, this is motivated by variables these as the individual’s current credit score standing and amount of overall publicity.

Securing car loans irrespective of credit rating rating

By means of Geotab

A superior credit history rating will unquestionably make improvements to your likelihood of securing car funding and locking up the finest fascination charges. On the other hand, it’s not all doom-and-gloom for prospective car or truck potential buyers with weak scores as they are not entirely without the need of options.

Irrespective of your credit rating, hunting close to and thinking of the a variety of funding options is remarkably recommended. It is just like searching for the car alone an average customer will examine various dealerships and negotiate vigorously just before creating the last conclusion.

Banks are the classic sources for obtaining a bank loan, but you could be restricting your alternatives if they are your only thought. Really don’t disregard choice creditors. Working with 3rd-celebration funding corporations, these as getting your vehicle bank loan by way of LoanCenter.com, may perhaps deliver you with favourable desire costs or financing terms.

It is essential to be aware that simply getting vehicle-mortgage preapprovals (distinct from precise bank loan apps) whilst procuring close to will not affect your credit score rating because most scoring types do not address this as a tricky enquiry.

In summary, a weak credit rating score may possibly push the cheapest desire charges out of attain. Even so, having a number of alternatives will enhance your probabilities of discovering a package with an curiosity level that matches in your price range and allow for you to obtain your wished-for car or truck.

[ad_2]

Supply website link

More Stories

Purple Heart Car Donation Tax Deduction

Who Should Consider A Fat Tire Electric Bike?

G70 740i Test Drive Impressions Review (From a G12 M760 Owner)